By Otto Fajen, MNEA Legislative Director

Trustees present

Jason Steliga, Chair

Chuck Bryant

Allie Gassman

Beth Knes, Vice-Chair

Dr. D. Eric Park

Katie Webb

SYSTEM OPERATIONS

The Board meeting started at 9:00 a.m. The Board approved the minutes from the December 6, 2022, meeting. The Board recognized the re-appointment of Chuck Bryant as a member of the Board of Trustees and established the order of business.

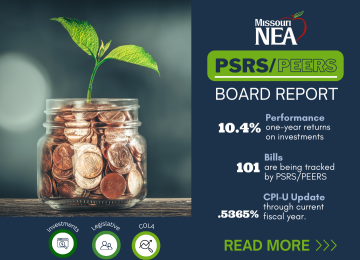

INVESTMENTS

Investment Performance Report - Craig Husting (PSRS staff) and Michael Hall (Russell) reviewed the December 31, 2023, investment update and provided the most recent information. Calendar year 2023 was a better market year than 2022 for both stocks and bonds. The one-year PSRS/PEERS investment return is 10.4% while the fiscal year return (July 1, 2023, through December 31, 2023) is 4.0%.

Husting discussed the current asset allocation of the PSRS/PEERS portfolio, and reviewed the long-term strategy, portfolio themes and the broad portfolio expectations. The Systems have been implementing the increase of private risk assets toward the goal of 40% of assets. Private equity market valuations are done on a quarterly basis and thus lag slightly behind the response of other asset classes. The Systems continue to manage total assets with less risk and more return than other comparable plans over all periods of one year or longer.

Anti-Terrorism Policy - Mr. Husting reviewed the Systems’ Anti-Terrorism and Economic Sanction Investment Policy. The Policy requires PSRS/PEERS staff to provide a report to the Board on an annual basis that identifies any investment actions taken due to links to terrorist or sanction-related activities. No action by the Board was needed.

Affirmative Action Policy - Mr. Husting reviewed the Systems’ Affirmative Action Policy and Procurement Action Plan. The Policy requires PSRS/PEERS staff to provide a report to the Board on an annual basis regarding the Systems’ efforts to assure equal opportunities for minorities and women as money managers, brokers, and investment counselors. The Systems are complying with the policy. No action by the Board was needed.

Asset Allocation Review - Mr. Husting and Mr. Hall reviewed the Systems' asset allocation. No action was needed by the Board. The report provided an update on the long-term (10-year) expected return from the PSRS/PEERS' asset allocation given changing capital market assumptions over the last year. PSRS staff provided updated capital market return and risk assumptions for several asset classes, as well as total portfolio projections.

Safe Assets Program Review - Mr. Frank Aten and Mrs. Jessica Wilbers (PSRS staff) reviewed the Systems' Safe Assets portfolio including program objectives, guidelines, and long-term results. The 15-year annualized return for the Safe Assets composite for the period ended December 31, 2023, was 1.8%.

MANAGEMENT REPORT

Audit Committee for Board Election – The Board voted to delegate to PSRS staff the task of organizing the audit committee composition, time to meet, etc. The audit committee will be comprised of representatives from various education associations.

RFP for Board Election - The Board voted to delegate to the PSRS staff committee the authority to approve the Request for Proposal (RFP) for the Board election.

Employer Services - Ms. Stacie Verslues and Ms. Dellanta Butler (PSRS staff) presented a report on the services that the Systems provide to employers, primarily to school districts, community colleges and associations. The staff educate and communicate with employers and review submitted information. They also do the GASB68 report and year-end audit reports.

Internal Audit Charter - Mr. Jeff Hyman (PSRS staff) presented a report on proposed changes to the Internal Audit Charter. These changes include: 1) the Board will approve the Internal Audit Plan and Internal Audit Charter, 2) the Board will conduct an annual performance review of the director of internal audit, and 3) the Board will approve all decisions to hire or terminate the director of internal audit. The Board voted to approve the proposed changes.

Legislative Update – Mr. Mike Moorefield (PSRS staff) government relations consultant Mr. Doug Nelson presented the February legislative update. Mr. Moorefield and Mr. Nelson gave the Board an overview of the governor's fiscal year 2025 budget recommendations and discussed the DESE budget. The report addressed the investment mandate legislation that could impact the Systems and provided an analysis of the three pieces of legislation that would amend the Systems' statutes. Finally, Mr. Nelson provided an overview of the current legislative activity of the General Assembly. As of February 2, 2024, the General Assembly had filed more than 1,900 legislative bills and resolutions. PSRS/PEERS is tracking 101 bills.

Actuarial Services - Ms. Anita Brand (PSRS staff) discussed the actuarial services provided to the Systems by the actuary PwC US. The report addressed both issuing a Request for Proposal (RFP) for actuarial services and negotiating a new contract with the current actuary. Staff anticipates negotiating a new contract with the current actuary for review by the Board of Trustees at their April 2024 meeting.

Ms. Christina Bisges (PSRS staff) discussed the upcoming actuarial audit. The Systems must conduct an actuarial audit of the retained actuary no less than every 10 years, while the Board conducts an audit every five years. The report included an overview of the most recent actuary audit and the current RFP for actuarial audit services. Staff expects to provide a recommendation to the Board at the April 2024 meeting regarding an actuarial firm to conduct the audit.

Year in Review (Areas of Impact) - The report focused on various new projects undertaken by the Systems. The report mentioned key projects and impacts affecting five key areas: members and employers, staff, investments, Board members and government relations.

Current CPI-U Update – The Board reviewed CPI-U data. The current fiscal year CPI-U is .5365 % through December 31, 2023. Under current policy, when the final CPI-U for a fiscal year is between 2.0% and 5.0%, the Board will make a COLA for eligible retirees of 2.0%. When the CPI-U is between 0.0% and 2.0%, the Board will make a COLA for eligible retirees of 2.0% when the cumulative CPI-U growth reaches or exceeds 2.0%.

Public Comment – There was no public comment.

The public meeting adjourned, and the Board went into closed session at 12:36 p.m.

Read past issues of the MNEA PSRS-PEERS Board Report at www.mnea.org/psrs.