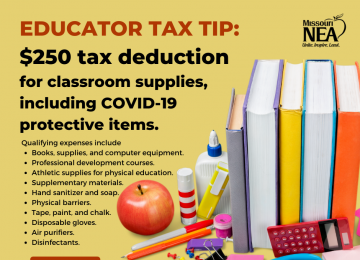

Thanks to the Biden Tax Plan, educators will be able to deduct up to $250 on classroom and COVID-19 protective items for the 2021 tax year. And, YES, if you are married and both of you are educators, you can double your deduction for a total of $500.

The Educator Expense Deduction would be taken on Schedule 1, Line 11, of Form 1040 or 1040-SR and considered an "above-the-line" deduction. An above-the-line deduction, also known as adjustments to income, is a tax break that lowers the amount of tax you have to pay by effectively reducing your gross income. The deduction removes certain expenses, such as classroom and COVID-19 related expenses, from your gross income so that you’re left with your adjusted gross income.

The best thing about the Educator Expense Deduction is that you can claim the tax break without itemizing your deductions. Even if you’re taking the standard deduction, you can still use education-related expenses up to $250 as an adjustment to your income to shrink your tax bill.

Qualifying expenses include the following:

- Professional development course fees

- Books

- Supplies

- Computer equipment, including related software and services

- Other equipment and materials used in the classroom

- Face masks.

- Disinfectant for use against COVID-19.

- Hand soap.

- Hand sanitizer.

- Disposable gloves.

- Tape, paint or chalk to guide social distancing.

- Physical barriers, such as clear plexiglass.

- Air purifiers.

- Other items recommended by the Centers for Disease Control and Prevention to be used for the prevention of the spread of COVID-19.