By Otto Fajen, Director of Legislative Policy

Trustees present

Dr. D. Eric Park, Vice Chair

Chuck Bryant

Allie Gassman

Amanda Perschall

Katie Webb

Trustees absent

Beth Knes, Chair

SYSTEM OPERATIONS

The Board convened on August 25, 2025. The Board approved the minutes from the June 9-10, 2025, meeting and established the order of business.

INVESTMENTS

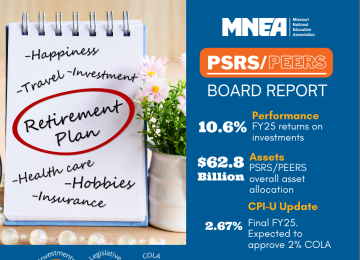

Investment Performance Report – Craig Husting (PSRS staff) and Michael Hall (Russell) reviewed the Systems’ FY 25 investment performance. The Systems’ returns for the fiscal year were +10.6% net of all fees and expenses. These returns are in excess of the assumed annual return of 7.3% and will improve the Systems’ funded status. FY 26 returns for the period from July 1 to August 22 are 1.86%.

The Systems have shown 1.55% of annualized alpha (the excess return over policy benchmarks) over the last five years, and this excess return has added $5.1 billion in value to the Systems. The Systems’ 10-year investment performance remains in the top quartile relative to other large public plans.

The report addressed the market and investment environment in FY 25. This year was a time of volatility in the stock market. The U.S. dollar is down 13% since the start of 2025, and the weaker dollar has lifted U.S. investors’ international returns. Treasury returns are higher, and private credit has shown a consistent, positive return. Staff believe private equity and real estate markets will be in a better environment going forward compared to the previous three years. Stock market values are at peak levels. Higher bond yields bode well for future returns. Public equity risk is being reduced by reducing the Systems’ overweight allocation.

The Systems’ investment policy seeks to provide downside protection. This means the Systems’ experience less of a loss in declining markets. Correspondingly, the policy means the Systems’ investments are slower to increase during rising markets. The Board adopted minor changes to the investment policy as recommended by Staff, including changes to address new requirements enacted by HB 147, changes regarding hedged assets, and changes regarding private equity and private credit. These changes put existing practices into the investment policy.

Total System assets are $62.8 billion. The investment report provided a broad overview of how the PSRS/PEERS’ portfolio is structured, including estimated asset allocation for PSRS/PEERS as of June 30, 2025.

Michael Hall also led a discussion of the Systems’ investment beliefs. Investment philosophy and beliefs can command systemwide support, align with operational goals, and inform decisions. Staff will discuss investment beliefs with Board members individually and in small groups to begin the process. Adoption of investment beliefs later this year will help prepare for the asset/liability study and experience study that will both be conducted in 2026.

MANAGEMENT REPORT

Member Services Benchmarking – The system hires CEM Benchmarking to review PSRS/PEERS member services and compare them both to the entire plan universe of CEM clients and to comparable public pension plans. CEM reported that PSRS/PEERS again has the second-highest rated services in our public plan peer group. Meanwhile, PSRS/PEERS member service costs are slightly below the median for the peer group. This evaluation gives the Board outside confirmation that the Systems provide a broad range of outstanding member services efficiently.

Key accomplishments – Staff reviewed recent staff work in key areas, including the WMS member document system, GFOA Certificate of Achievement award for the ACFR for the 31st consecutive year, LEAD supervisor training program, PSRS summer interns, IT job shadowing, PSRS investment interns, and national investment group recognitions for staff.

Member Services Update – Member Services staff shared updated information about membership, retirements, member inquiries, service purchases, working after retirement, website services, member education meetings, and other member services issues.

PSRS active membership is 77,802 and has declined slightly in the last three years, while the number of benefit recipients has increased to 72,599. PEERS active membership has increased to 54,841, while the number of benefit recipients has increased to 40,267. Retirements for 2024-25 totaled 2,756 for PSRS and 2,196 for PEERS.

Implementation of Regulation – The Board approved regulation changes recommended by staff concerning clarification of timing to file an application for service retirement and the substitute teacher Working After Retirement waiver. The proposed rules should be filed in October 2025 and become effective during the second quarter of 2026.

CPI update/COLA review – The Board reviewed the COLA policy and COLA history for the current fiscal year. The final FY 25 CPI-U was +2.67% through June 30, 2025. Under law and current policy, the Board is expected to approve a 2.0% COLA for eligible retirees beginning in January 2026.

Public Comment – None.

The public meeting adjourned, and the Board went into closed session.

To read past issues of the PSRS-PEERS Board Reports, visit www.mnea.org/psrs.