By Otto Fajen, MNEA legislative director

Trustees present: Jason Steliga, Chair; Dr. Kyle Collins; Beth Knes, Vice-Chair; Sharon Kissinger; Dr. Melinda Moss; Dr. D. Eric Park

The Board met on April 11 to review the Systems’ Non-U.S. Equity Portfolio and Real Estate Portfolio and met again on April 12 to conduct the remainder of the meeting agenda.

SYSTEM OPERATIONS

The Board approved the minutes from the February 28 and March 1, 2021 meetings and established the order of business.

Board Elections – The Board accepted the certification of the election of Jason Steliga and Allie Gassman, both MNEA members, as members of the Board of Trustees.

Election of Officers - As required by Board regulation, the board of trustees unanimously elected Jason Steliga as Chair and Beth Knes as Vice-Chair to each serve one-year terms starting July 1, 2022.

Interest Credit Rate and Purchase Interest Rate - The interest credit rate for the current fiscal year is 1.0%. The Board increased the interest credit rate for next fiscal year to 2.0%, based on staff recommendation. The Board also approved the staff recommendation to set the purchase interest rate for next fiscal year at the current assumed rate of return of 7.3%.

INVESTMENTS

Investment Performance Report - Craig Husting reviewed the estimated March 31, 2022 investment results. Husting noted that the treasury yield curve is moving back up and more like what it was in 2018. The yield curve is also inverted and the yield for five-year maturity is slightly about the ten-year rate. The rising rates have resulted in losses in the safe assets portfolio.

U.S. equity returns are 11.9% while non-US markets are lower at 1.2% and emerging markets are down 11.4% for the last year. The report provided a broad overview of how the PSRS/PEERS’ portfolio was structured including an estimated asset allocation for PSRS/PEERS as of March 31, 2021. The Systems’ preliminary investment return for the fiscal year to date (July 1, 2021 thru March 31, 2022) was approximately 4.0%. The Systems have lost 2.3% this calendar year, relative to 5.3% loss in Russell 3000. The hedged assets have helped the Systems. Rising rents have helped produce more returns in the real estate portfolio.

Staff discussed the Systems’ allocation policy and the asset positioning relative to those policy benchmarks.

Asset/Liability Study 2022: The Board approved the staff recommendation of a 5% increase to private equity to 21% and a 5% decrease to safe assets to 20%. The target asset allocation considers the actuarial expected return, future contributions, liabilities and negative cash flow. Increased earnings by optimizing the investment policy reduces the amount of future contributions. The funded ratio and contribution rates for PSRS/PEERS are highly sensitive to expected and realized investment returns and the volatility or path of those returns over time.

The study was based on the financial strength of PSRS/PEERS using figures from June 30, 2021. The study examines the evolution of actuarial liability over time under many different scenarios and assumptions. Assumptions of inflation are a primary factor in liability over time. The study projects the distribution of annual earnings based on the asset allocation policy. The probability of making the 7.3% assumed rate of return is 37%. The funded status is helped by recent market gains that have not been included in the actuarial value.

MANAGEMENT REPORT

External Auditor – The Board adopted the staff recommendation to extend a new three-year contract to Williams-Keepers Inc. as the Systems’ external auditor.

Disability regulation – The Board reviewed the purpose and objectives of the disability policy. The Board approved the staff recommendation to change the definition of livelihood for disability determinations and approved a proposed rule to implement the change. The Systems had used a single doctor as medical advisor for review of records and determinations for a 20-year period. In 2019-20, the Systems researched the option to use technology and remote access to specialists and build additional relationships. In 2021, the Systems made the change to use other advisors. The law requires disability to be permanent and make the member incapable of earning a livelihood in any occupation. The definition of permanent by the Board calls for periodic review over time. The definition of livelihood is based on SSDI benefit, which is $16,200 for 2022. Staff recommends changing the definition of livelihood for making a determination, based on earning at least 75% of last three years of last salary in their region and considering vocational review. The policy calls for a vocational expert to be involved in the review. The post retirement livelihood definition will remain subject to SSDI limits.

Legislative Report – Sarah Swoboda and Jim Moody gave the legislative report. Mr. Moody gave a revenue update including his analysis of the budget, possible tax changes and the impact of various federal revenues on state and local revenues over the next few years.

The state General Revenue fund has a $3 billion cash balance. All funds total $12 billion, not including over $1 billion in federal ARPA funds. The state is experiencing a huge financial bubble. Moving the 2020 tax due date moved $783 million into FY 2021. Sales tax collections and personal income remain high, and state revenues have not declined this year. Revenues are up about $800 million or about 5.59%. This increase will trigger additional SB 509 (2014) tax cuts along with the 2024 tax cut from SB 153 in 2021.

The Department of Revenue has made many reporting errors in recent months. They deposited local sales taxes into GR. There have also been problems with tax payments through the data portal. Also, the payments of a big retailer weren’t processed in February. So Moody is skeptical of the data.

Adjusting for the due date funds received in FY 2021, the state had $700M growth in GR last year and is also seeing big growth again this year. Moody predicts this growth will probably bust without a recession, but there could be a recession. The big factor of concern is inflation. The Ukraine war or inflation could slow the economy. There will be a downturn, and the chance of recession is increasing towards 50%. The state has plenty of cash to cushion a downturn. Even a decline to $10 billion in GR is above the pre-pandemic level. Moody thinks a downturn will probably not come before 2024.

Overall state revenues will stand at record levels during the next fiscal year, and the budget will remain well-funded for as long as the federal funds last. However, the triggering of additional state tax cuts will leave long-term impacts in succeeding years.

In the state budget bills for next year, the Governor’s budget left a cash balance of $1.6B and the House left a balance of $1.8B. There is a lot of one-time funding devoted to capital expenditures. The Senate will spend somewhat more but leave some reserve, and fund balances will continue to grow.

Sarah Swoboda discussed the PSRS Defined Benefit Plan Resolution, Benefit Resolution, Investment Resolution and COLA Resolution and mentioned that PSRS is tracking 458 bills that would affect the Systems, including:

Other legislative topics:

1) Adding a 2.55% benefit factor for extended service of 32 years or more. The Board approved a motion to support 2.55% for service beyond 30 years. See HB 2161 (Dinkins).

2) Increasing critical shortage option from 2 years to 4 years. The Board approved a motion to support this change. See HB 1881 (Rusty Black).

3) Critical shortage change to allow a superintendent for 2 years after 1 year or in emergency.

4) Critical shortage flexibility between PSRS and PEERS provisions.

5) For PSRS retirees in non-certified positions, increase allowed earnings from $15,000 to SS earnings limit. Since this may change, the Board did not yet take a position in support. See HB 2114 (Rusty Black). Other versions would increase to 60% of district average salary. See HB 2194 (Ann Kelley) and HB 2216 (Bromley).

6) Benefit pop-up for same sex relationships. The Board approved a motion to support this change. See SB 712 (Razer).

7) Broad waiver of WAR limits for several years. HB 2799 (Pike) is now an omnibus bill with 3-year extension of WAR waiver, increase to Critical Shortage, 2.55% factor for 32 years and provisions for other systems.

8) Substitute teaching waiver of WAR restriction until December 31, 2025. Actuary says this change has a small cost if it is temporary. The language is now in HB 2304 (Lewis), HB 1750 (Basye), HB 1753 (Basye), and HB 1998 (Davidson).

9) PSRS proposal for 25% of FAS instead of current 550 hours/50%. MNEA opposes reducing the allowed earnings percentage for PSRS retirees. See HB 2787 (Rusty Black).

9) HB 1998 (Davidson) would allow district-issued certificates.

10) SB 767 (O’Laughlin) is a placeholder bill. This bill is not moving.

11) SB 836 (O’Laughlin) would limit participation in a second DB plan in Missouri. Districts might have to set up a DC plan. This bill is not moving.

12) Investment restrictions with companies that require COVID vaccine for employees. This type of requirement is hard to know about and track. Also, several bills restrict certain kinds of investments.

13) SB 871 (Eigel) creates pension tax deduction.

14) Minimum teacher salary increases. HB 1770 (Lewis) is an omnibus bill with some minimum salary increases. House removed Governor recommendation for minimum salary funding of $21 million and put in $37M in Career Ladder funding.

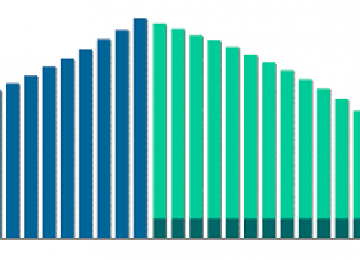

CPI update/COLA review – The Board reviewed the COLA policy and COLA history over many years. Current CPI-U is up 4.4241% through February 28, 2022. Under current policy, the Board will make a COLA for eligible retirees for next year if the cumulative figure at the end of this fiscal year exceeds 2.0%. If CPI exceeds 5% at the end of the fiscal year, the Systems will provide a 5% COLA for eligible retirees.

Public Comment – None.

The public meeting adjourned at 11:12, and the Board went into closed session.